VycePay

Seamless Payments Across Africa

VycePay: The Identity-Driven Platform Powering Africa's Financial Future. Spend, Send, and Grow Your Business—Every cross-border and P2P transaction converts into a verifiable financial identity that unlocks formal credit.

Formalizing Africa's Digital Economy.

VycePay is the border-agnostic platform that ensures every P2P and trade transaction builds your financial future

Fragmentation & Identity

Financial fragmentation is Africa’s biggest barrier to credit and a driver of exploitation. Kenya’s e-market is projected to hit $40B by 2025, yet 45% of Kenyans rely on informal lenders, and the SME credit gap stands at $20B—all driven by the lack of a unified financial identity that enables access to formal credit.

Missed Credit Opportunity

Banks are missing out on capturing the $20 Billion SME funding gap because millions of high-growth customer activities are not verifiable. This is the direct commercial loss for the financial sector.

Costly Fee Erosion

Cross-border transactions average over 7%+, eroding SME profits and household wealth. We strategically eliminate this friction (via VycePay) to acquire the high-volume transaction data needed to power the VyceScore identity layer.

Unlocking Africa's Economic Potential

The VycePay Solution

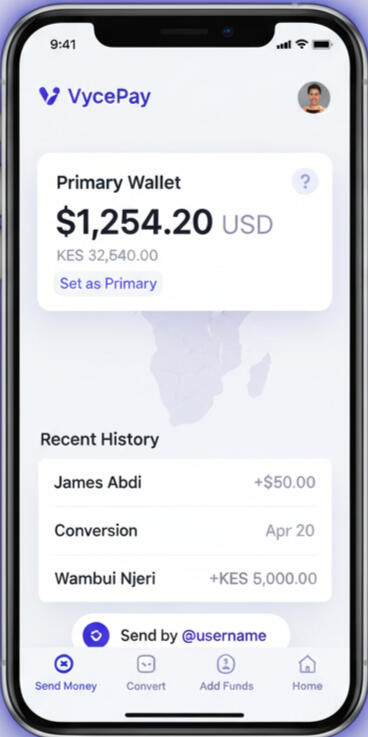

We are building a unified digital wallet that turns a multi-billion dollar problem into a simple, beautiful, and on-demand financial tool, while simultaneously building a verifiable digital identity for Africans

Instant Currency Exchange

Instantly exchange money at fair, transparent rates. No hidden fees, no complex steps — just seamless cross-border payments, as easy as a local transfer.

No SIM Cards, No Hassle

Forget juggling SIM cards or managing multiple mobile money accounts every time you cross a border. With VycePay, your wallet travels with you. Our platform connects directly to your device, giving you a single, secure financial passport across Africa.

Dismantling Financial Barriers. Unlock Your Economic Potential.

The way you move money should work for you, not against you. With VycePay, every transaction, no matter the location or size, matters. We securely transform your active payment history into a foundational digital financial identity. This verifiable track record is your new asset, built to power your future and open financial opportunities like better access to working capital and essential services from our trusted partners.

Our Progress So Far

We're Already Building and Validating

Our MVP is tested, and the response from users confirms we're on the right track to solve Africa's payment challenges.

MVP Tested

100% of Core Features

Our Minimum Viable Product (MVP) has been fully developed and rigorously tested, demonstrating the core functionality of VycePay. We've proven that seamless cross-border payments are not just a vision, but a reality.

Strong User Demand

80% Ready to Use

In our early user tests and surveys, 80% of participants expressed immediate interest in using VycePay, confirming it directly solves a major pain point in their financial lives. We’ve already seen strong traction, with 100+ early user sign-ups and growing

Partner with Us to Transform Africa's Payments

We're building the future of finance for an entire continent. Discover how you can be a part of this impactful journey.